YOU LOVE PROPERTY

SO DO WE.

Let us help you structure,grow,protect

and minimise your taxes as you build your

portfolio or development business

YOU LOVE PROPERTY SO DO WE.

Let us help you structure,grow,protect

and minimise your taxes as you build your

portfolio or development business

There are many ways to structure a property development, taxes play a big part

Let us help you plan it from the start

MAIN RESIDENCE

Living in a property changes the taxes payable on sale. Your sale may be free of taxes.

Let us work it all out and maximise the result for you.

PROPERTY DEVELOPMENT

Developments require careful planning. Taxes are a critical part. Asset Protection from one deal to the next. Division 7a.

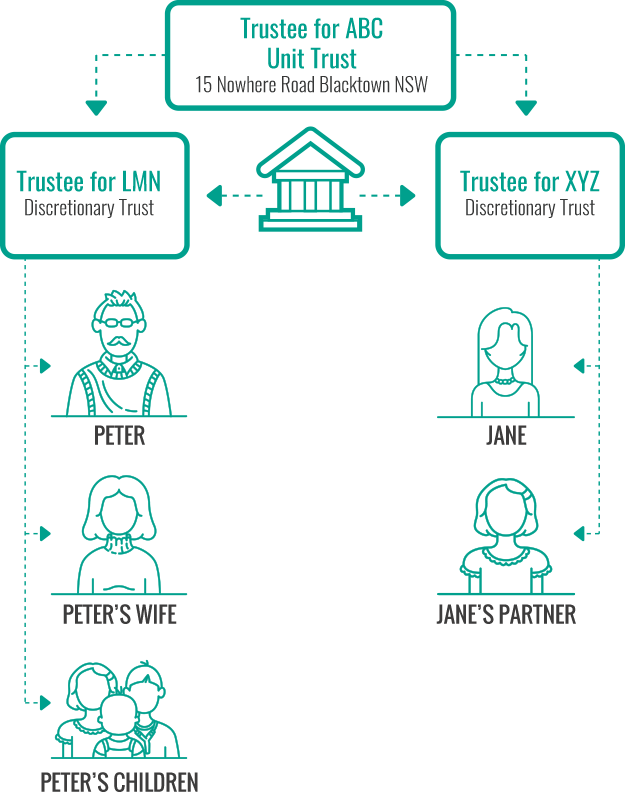

The concept of bucket companies and using them as “banks”. Unit Trusts and potential stamp duty savings on retention or transfer

We have it covered.

SMALL BUSINESS

Run your own small business? Make sure your investments assets are protected from your business assets and business risks.

Individual names?Trust? Companies?Gift or loan back strategies? Flowing profits from a profitable trust to a loss trust.

Discuss with us to make sure it complies. The small details count.

DID YOU KNOW?

An individual who acquires a residential rental property in their own name, a discretionary trust or partnership can’t transfer the property to a self managed superfund.

A person who acquires the property in a unit trust can eventually transfer the units to a self managed superfund.

There are also certain land tax and stamp duty advantages in many states from using a unit trust to hold property.