As property deals become more expensive many people are looking to minimise the risk by doing a development with others.

Sometimes it is two family members together, other times it will be unrelated parties looking to pool resources and come together to purchase a site, development it and sell it.

A common question is how do we structure things for this type of property development ?

Two Common Structures

1. Company

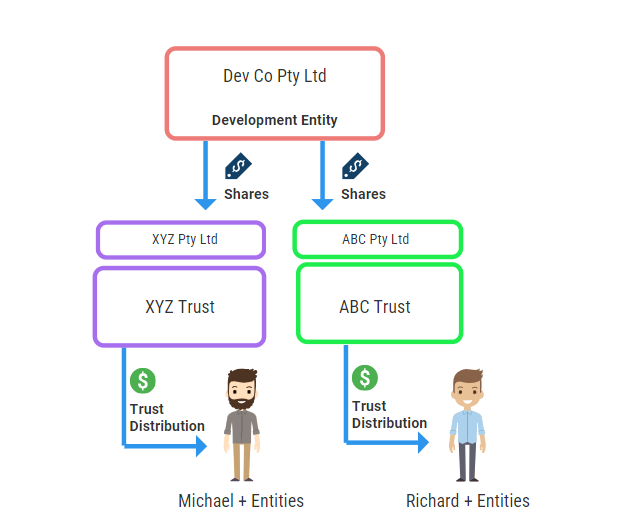

With this structure a company (Pty Ltd) acquires the land and undertakes the development.

The shares in the company are then held by each parties respective entities. This is best illustrated in the diagram below.

What Happens with a Company Structure

A. During the Development.

The development will eventually be sold and the company will make a profit on the sale.

For companies undertaking developments they will generally be what is called a Base Rate Entity and so a 25% corporate tax rate will apply to the profits on sale.

It is important to note that for property developments, as they are on revenue account and not capital account, the capital gains tax discount (50% if held for more than 12 months) does not apply.

TAX TIP

Sales on revenue account are accounted for when settlement occurs. NOT when the contracts are exchanged. This is different to the sale of property on capital account.

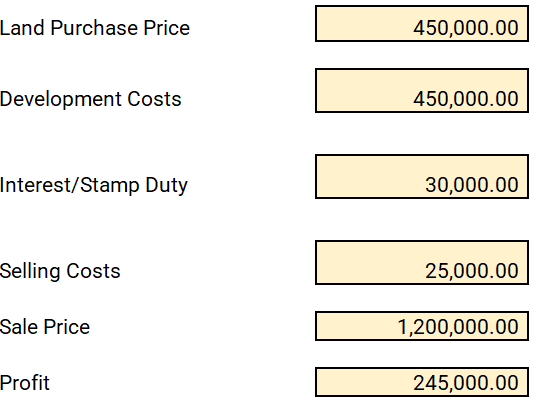

Let’s look at an EXAMPLE. In this example we will exclude any GST and assume the figures are exclusive of GST

B. How is Tax Calculated

As discussed earlier as the company is a base rate entity it will pay tax at a rate of 25%.

So the tax payable will be $61,250.

Which means that the company ends up with cash in the bank of $183,750.

This tax won’t be payable until the company lodges it’s income tax return.

C. Investors Now Want Their Money

This is where a company can be a more problematic structure for doing a development with others.

The investors will generally want the proceeds immediately, or soon after, sale.

For a company to extract the profits to the shareholders it can be done via a dividend or via a loan

A loan won’t be ideal as it generally be subject to Division 7a (unless the shareholder is another company) and it still needs to be cleaned up eventually through dividends being paid out to the shareholders. Messy.

So the company declares a dividend.

The problem that we have is that in order to pay a fully franked dividend there must be sufficient franking credits.

In the example above as the company hasn’t yet paid any income tax then there aren’t sufficient franking credits.

A strategy to consider is to pay a fully franked dividend without sufficient franking credits which will mean franking deficit tax will be payable by the last day of the month immediately following the end of the entity’s income year (generally end of July)

The company then receives a tax offset for the franking deficit tax paid.

This sounds complex and messy you say. Well, it is and if you miss the deadlines then you have issues.

So that leads to another structure that is often used.

2. Unit Trust

A. During the Development

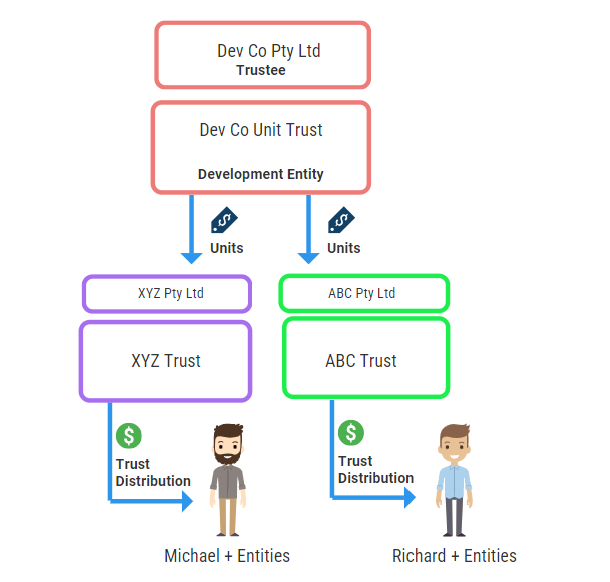

With this structure a Unit Trust acquires the land and undertakes the development.

It is common for the trustee of the Unit Trust to be a corporate entity. Note that the corporate entity is not taxed as it merely acts as trustee.

The units in the Trust are then held by each parties respective entities. This is best illustrated in the diagram below.

B. How is Tax Calculated

Trusts do not generally pay tax (unless the profits are not distributed) and so the profits and cash are then distributed down to the unitholders.

In the example above $122,500 is transferred to each unitholder and the unitholder pays tax (if it is a discretionary trust holding the units it will distribute that profit and that ultimate beneficiary will pay the tax)

C. Investors Now Want Their Money

Things are much easier with a unit trust.

The unit trust makes a profit and distributes it to the unitholders and they manage their tax liabilities respectively.

This structure is generally much more friendly for distributions of profits and the reason it is a common structure over a company.

Interested in delving deeper into the intricacies of property tax solutions? Find a specialist in investment property accounting to assist you with tailored solutions. Your journey towards successful property development begins with informed choices and strategic planning.