CGT Main Residence Subdivision and Selling a Block

You have finished the subdivision of your main residence and selling the vacant block and there is no CGT woohoo. Sorry but that is wrong.

What !! You mean i pay capital gains tax. Sacre bleu.

This is becoming quite common as some people have a large block which has their main residence on part of the block. They then want to subdivide the block and sell part of the land to get some extra cash.

To determine the tax treatment first consider whether the sale will be on capital account or revenue account

A case where something is more likely to be on capital account is where the property has been held for many years and due to rezoning by local council it allows someone to consider subdividing and selling the vacant block.

Do I pay CGT on the subdivision of the land ?

Subdividing the land does not result in a CGT event if the person retains ownership of the subdivided blocks.

The date of acquisition of the new blocks is the same as the acquisition date of the original block.

The subsequent sale of the block should not be treated as a disposal of part of the original asset but is treated as the disposal of an asset in its own right.

The original cost base is therefore apportioned between the blocks of land on a reasonable basis.

Where the land is divided into blocks of equal size and value it would be reasonable to allocate the cost base of the original land equally between each block.

Otherwise, a reasonable apportionment of the cost of the land itself can usually be achieved on an areas basis if all the land is of similar market value.

Therefore, you do not make a capital gain or a capital loss at the time of the subdivision.

Will I pay CGT when I sell the block separately to the main residence ?

A capital gain or loss you make in relation to a CGT asset that is your dwelling or your ownership interest in the main residence dwelling is disregarded if the dwelling was your main residence throughout the ownership period.

The exemption for a main residence is extended to include any land that is adjacent to the dwelling, to the extent that it is used for private or domestic purposes in associated with the land and it is disposed at the same time as the main residence dwelling.

Section 118-165 ITAA 1997 states

“The exemption does not apply to a CGT Event that happens in relation to land, or a garage, storeroom or other structure, to which the exemption can extend under section 118-120 (about adjacent land) if that event does not also happen in relation to the dwelling or your ownership interest in it.”

If you dispose of the land separately from the main residence the exemption does not apply to the land. For example if you dispose of the adjacent land to the same purchaser but at a different time from when you dispose of the main residence or you dispose of the adjacent land and the main residence to different purchasers even if the disposal happens at the same time.

How is the capital gain calculated ?

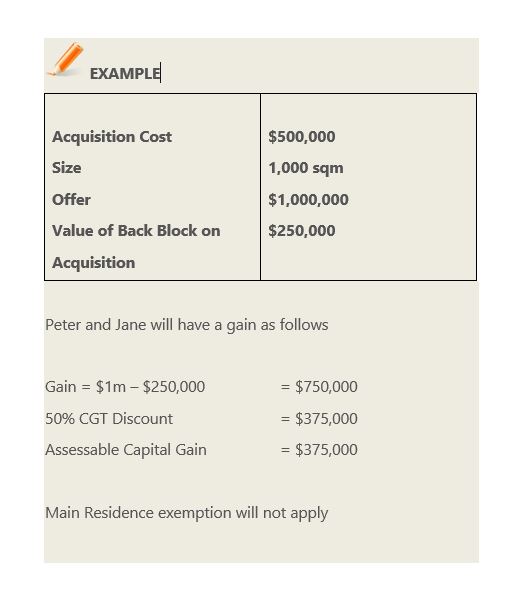

Let’s assume that you have a main residence you purchased in 2001 for $500,000 and decide you want to sell half of the block and keep the main residence.

You have an offer of $1m from a developer to acquire this land.

For more on capital gains tax and the main residence you might be interested in https://www.propertytaxsolutions.com.au/capital-gains-tax-when-you-sell-your-property/

Frequently Asked Questions

If you retain ownership of the subdivided blocks, subdividing your land does not result in a Capital Gains Tax (CGT) event. However, selling a block that was part of your main residence separately may attract CGT, as it is treated as a disposal of an asset in its own right.

A case where the sale is more likely to be on capital account is when the property has been held for many years, and due to rezoning by the local council, subdivision and selling the vacant block become a viable option.

The original cost base is apportioned between the subdivided blocks on a reasonable basis. This could be an equal allocation if the blocks are of the same size and value, or based on the market value of different areas if they are not equal.

The exemption for a main residence is extended to include any land adjacent to the dwelling if it is used for private purposes and it is disposed of at the same time as the main residence dwelling. However, if you dispose of the land separately, the exemption does not apply.

The capital gain is calculated based on the selling price of the land and the original cost base. For instance, if you bought your residence (including land) for $500,000 and sell a subdivided block for $1 million, the capital gain will be the selling price minus the apportioned cost base of the sold block.